Indian equities hover in a narrow range on Monday, September 15, 2025, as traders brace for a pivotal flat rate decision that could reshape global capital flows.

Mumbai’s benchmark indices, the Nifty 50 and BSE Sensex, opened marginally higher on Monday, September 15, 2025, but quickly slipped into flat territory amid cautious sentiment ahead of the US Federal Reserve’s rate decision later this week. At 10:18 AM IST, the Nifty 50 traded 0.11% lower at 25,085.45, while the Sensex fell 0.04% to 81,865, reflecting investor wariness after last week’s sharp rally.

Why it Matters

The flat performance in the India stock market today 2025 underscores broader vulnerabilities in South Asia’s emerging markets, where foreign investment flows—often swayed by US monetary policy—play a critical role in funding growth and stabilising currencies. A dovish Fed rate decision 2025 India could unlock inflows, bolstering regional economies from India to Pakistan, but any hawkish surprise risks amplifying volatility and pressuring rupee-like currencies across the subcontinent.

India Stock Market Today 2025: A Cautious Open

The India stock market today 2025 mirrored a broader Asian trend of subdued trading, with benchmarks showing minimal movement as participants adopted a wait-and-see approach. The Nifty 50, which had surged 1.5% last week to notch its longest winning streak in a year—eight consecutive sessions—faced profit-taking early in the session. Similarly, the Sensex edged lower after an initial uptick, with early data from 9:17 AM IST showing it at 81,948.63, up 0.05%, before paring gains. By mid-morning, volatility crept in, with the Nifty dipping below 25,100 at points, trading around 25,089.90, down 0.10%.

Analysts attributed the consolidation to a mix of domestic and global factors. “There’s a sense of caution (in Indian equities) after the sharp run-up last week,” said G. Chokkalingam, founder and head of research at Equinomics Research. He highlighted tightening liquidity, driven by persistent foreign institutional investor (FII) outflows, promoter stake sales, and a diversion of funds towards high-profile initial public offerings (IPOs). Despite these headwinds, nine of the 16 major sectors on the Nifty advanced modestly, offering some cushion to the benchmarks.

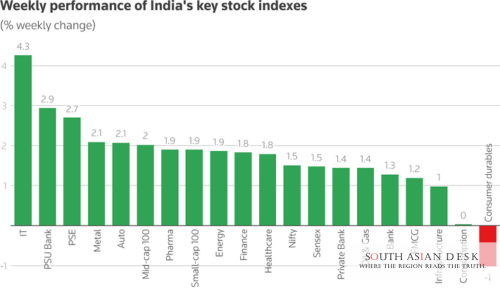

Sector-Wise Breakdown in India Stock Market Today 2025

Information technology shares, which had rallied 4.3% over the prior week, emerged as the biggest drag, declining 1% and weighing on the indices. Heavyweights like Infosys and Tech Mahindra contributed to the sector’s slide, amid broader profit-booking in high-valuation names. In contrast, small-cap and mid-cap indices bucked the trend, adding 0.5% and 0.1%, respectively, buoyed by resilient domestic demand signals.

Banking and financial services showed mixed signals, with the Bank Nifty holding steady after a 0.26% gain in the previous session. Consumption-themed stocks received a lift from recent government tax cuts aimed at spurring household spending, a move that had fuelled last week’s optimism. Alcobev players like Radico Khaitan and Allied Blenders rose about 2%, while United Spirits gained 0.5% following a “buy” recommendation from Jefferies.

Individual movers added colour to the otherwise muted session. Railtel Corp jumped 7.6% after securing a 2.1 billion INR order, while Engineers India and Ceigall India each advanced around 2% on fresh contract wins. On the downside, KRBL plunged 9% following the resignation of an independent director over corporate governance concerns.

Flat Rate Decision 2025 India: Looming Global Cues

The Fed rate decision 2025 India remains the focal point, with markets pricing in a near-certain 25-basis-point cut at the Federal Open Market Committee’s (FOMC) September 16-17 meeting. Fed funds futures indicate an 88% probability of this quarter-point reduction, with a slim 12% chance of a more aggressive 50-basis-point move. Investors are particularly attuned to Chair Jerome Powell’s post-decision commentary, which could signal the pace of future easing amid cooling US inflation and labour market softening.

For India, a rate cut would likely weaken the US dollar and Treasury yields, channelling capital towards emerging markets like those in South Asia. This dynamic has historically supported the India stock market today 2025, with lower US rates enhancing the appeal of higher-yielding Indian assets. However, ongoing US-India trade negotiations add another layer; progress here could catalyse a swift rebound, as noted by Chokkalingam: “Still, meaningful progress in U.S.-India trade talks could quickly spark a sharp recovery.”

The rupee, meanwhile, faces near-term pressure from potential tariff escalations in US trade policy, though bond traders anticipate a stable 10-year yield band of 6.40% to 6.52% this week, potentially dipping to 6.40% on dovish Fed signals. Gold prices, a barometer for rate expectations, held steady near record highs, underscoring the anticipated policy pivot.

Broader Asian Context for Fed Rate Decision 2025 India

Across Asia, equities traded flat, with Japan’s Nikkei and Hong Kong’s Hang Seng showing similar restraint ahead of the Fed’s deliberations. The Bank of Canada and People’s Bank of China are also in focus, but the Fed’s move dominates sentiment. For South Asian markets, this interconnectivity amplifies risks: a benign outcome could stabilise the region, while delays in domestic rate cuts—now pushed to early 2025 due to sticky inflation—might prolong pressure on growth-sensitive sectors.

Background

Last week’s rally in the India stock market today 2025 was underpinned by positive domestic catalysts, including government measures to boost consumption via tax relief and advancing US-India trade discussions. FIIs, after weeks of net selling, turned marginally positive in derivatives, hinting at renewed interest in consumption plays. The Nifty’s eight-session streak marked a rare bout of consistency, but mid-session volatility on Monday signals the fragility of this momentum.

What’s Next for India Stock Market Today 2025

As the week unfolds, eyes will remain on the Fed rate decision 2025 India for clues on global liquidity. A confirmatory cut could propel the Nifty towards 25,500, analysts suggest, while trade talk breakthroughs might accelerate FII inflows. In the near term, the India stock market today 2025 appears poised for range-bound action, with support at 25,000 and resistance near 25,200, until Wednesday’s verdict clarifies the path ahead.

Published in SouthAsianDesk, September 15th, 2025

Follow SouthAsianDesk on X, Instagram, and Facebook for insights on business and current affairs from across South Asia.