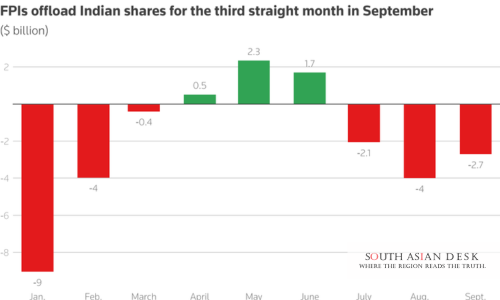

MUMBAI, India – Foreign portfolio investors (FPIs) net sold $2.7 billion worth of Indian stocks in September 2025, extending a three-month selling spree that has drained $17.6 billion from markets this year and raised red flags over the FPI outflow India trajectory.

This marks the third straight month of net outflows, with FPIs dumping shares at a clip unseen since the 2022 global turmoil. Data from the National Securities Depository Ltd (NSDL) confirms the equity pullback hit Rs 23,885 crore ($2.7 billion at current rates), partially offset by Rs 1,085 crore inflows into debt, for a net FPI outflow India of Rs 12,539 crore in the month. Year-to-date, total FPI outflow India stands at Rs 1,03,916 crore, second only to the Rs 1,85,000 crore exodus in the first nine months of 2022.

The September foreign investors $2.7 billion pull Indian stocks September 2025 stems from a cocktail of pressures. Heightened geopolitical risks, fresh U.S. tariff threats targeting India’s $87 billion annual exports, and steeper H-1B visa costs have squeezed the tech-heavy IT sector hardest. FPIs offloaded Rs 60,000 crore from IT alone this year, per NSDL sector breakdowns. Weaker corporate earnings and a strong U.S. dollar further lured capital to cheaper Asian peers like China, where valuations trade at half India’s multiples.

Foreign Investors $2.7 Billion Pull Indian Stocks September 2025 Hits Key Sectors

The FPI outflow India intensified in the final quarter, with daily NSDL data showing sharp sell-offs on key dates. On 1 September, FPIs net sold Rs 8,983 crore in equities, followed by Rs 3,414 crore on 12 September. Mid-month inflows, such as Rs 4,494 crore on 11 September, offered brief respite but failed to stem the tide. By month-end, the benchmark Nifty 50 eked out a mere 0.8% gain for September, while the BSE Sensex climbed 0.5%, lagging regional indices.

Sector-wise, the foreign investors $2.7 billion pull Indian stocks September 2025 ravaged technology and financials. IT firms, reliant on U.S. remittances, bore the brunt with $7.2 billion in year-to-date disposals. Power and consumer goods followed, each losing over $1 billion. Debt markets bucked the trend, attracting Rs 9,000 crore net since January, buoyed by India’s 6.5% fiscal year growth forecast and steady yields.

Analysts point to structural shifts. “Geopolitical tensions and tariff shocks make India less appealing short-term,” said Ajit Banerjee, president and chief investment officer at Shriram Life Insurance. “FPIs logically rotate to markets with stronger earnings visibility.” Banerjee’s view echoes NSDL’s compilation notes, which highlight custodial reports submitted to the Securities and Exchange Board of India (SEBI).

India’s equity markets, valued at $5 trillion, rely on FPIs for 20% of free-float ownership. The FPI outflow India erodes liquidity, widens bid-ask spreads, and pressures the rupee, which hit 84.50 per dollar on 30 September, its weakest in two years. The Reserve Bank of India (RBI) intervened with $5 billion in spot sales last month to stabilise the currency, per central bank forex data.

Why FPI Outflow India Matters for South Asia

In South Asia, the FPI outflow India reverberates beyond borders. As the region’s largest economy, India’s market volatility spills into Pakistan, Bangladesh, and Sri Lanka, where cross-border trade totals $50 billion annually. A weaker rupee inflates import costs for oil-dependent neighbours, potentially stoking inflation rates already above 7% in Pakistan.

Remittances, a lifeline for South Asia’s $400 billion economy, face headwinds from H-1B curbs. Indian diaspora in the U.S. sent $100 billion home in 2024; a 10% visa fee hike could trim that by $5 billion, per World Bank estimates. Bangladesh’s garment exports, tied to Indian fabrics, risk $2 billion in disruptions if U.S. tariffs escalate.

Regionally, the foreign investors $2.7 billion pull Indian stocks September 2025 accelerates capital flight to safer havens like Vietnam. South Asian bourses, from Karachi to Colombo, shed 3-5% in tandem last month. Yet, India’s dominance offers upside: Stabilised FPI flows could boost intra-SAARC investments, projected at $10 billion by 2030 under revived trade pacts.

SEBI data underscores regulatory resilience. The board’s June 2025 circular eased FPI registration to 10 days from 30, aiming to reverse outflows. “Streamlined norms will attract long-term capital,” a SEBI official stated in a September press note, though specifics on September impacts remain pending.

Background: A History of FPI Swings in India

FPI outflow India is not new. In 2022, amid Ukraine war fallout and Fed hikes, FPIs yanked $22.3 billion in nine months, crashing the Nifty 25%. Recovery followed in 2023 with $20 billion inflows, fuelling a 40% rally. 2024 saw balanced flows of $5 billion net, but 2025’s $17.6 billion equity drain signals deeper woes.

NSDL records show cyclical patterns tied to U.S. policy. Post-2016 elections, Trump-era tariffs first hit; Biden’s 2025 renewal, including 50% duties on electronics, mirrors that. Cumulative FPI outflow India since 2008 totals $150 billion during stress periods, offset by $500 billion inflows in booms.

RBI’s forex reserves, at $700.2 billion as of 26 September, provide a buffer. The central bank accumulated $25 billion this year despite outflows, via $150 billion in annual interventions. Yet, sustained FPI outflow India could test this, especially with oil at $80 per barrel straining the $600 billion import bill.

What’s Next for FPI Outflow India?

Policymakers eye counters. RBI’s October monetary policy may cut rates by 25 basis points to spur lending, while SEBI proposes tax breaks on long-term FPI holdings. Fiscal 2026 budget, due February, could slash GST on consumption to 12%, boosting earnings.

Experts forecast a pivot. “Valuations at 22 times forward earnings remain reasonable; pro-growth measures could lure $10 billion back by March 2026,” Banerjee added. If U.S. tariffs ease post-midterms, IT rebound might cap year-end FPI outflow India at $20 billion.

Still, risks loom. Escalating Middle East tensions could spike energy costs, amplifying the foreign investors $2.7 billion pull Indian stocks September 2025 legacy. Investors watch November’s U.S. data for clues on Fed pauses, pivotal for global flows.

The FPI outflow India saga underscores market interdependence. As September closes with $2.7 billion gone, India’s resilience will define South Asia’s fortunes in a turbulent year.

Published in SouthAsianDesk, October 1st, 2025

Follow SouthAsianDesk on X, Instagram, and Facebook for insights on business and current affairs from across South Asia.